If a Company Has a Check Nsf Do They Try and Cash It Again

When handling bookkeeping for your modest business, it's in your best interests to provide your customers with multiple ways to pay for appurtenances and services that you sell. Ane of the more mutual payment methods used by customers is to write a check.

Though customers similar writing checks because they're easy and convenient, many business owners are a trivial more hesitant to accept checks considering of the possibility of the checks being returned. However, there are ways for business owners to keep to have checks from their customers while also safeguarding their concern against receiving a bad bank check.

Nosotros'll explain exactly what an NSF bank check is and what y'all should practice if y'all do receive 1 from a client. We'll also give y'all some suggestions on how to protect your concern confronting NSF checks.

Overview: What is an NSF bank check?

An NSF check, or non-sufficient funds check, is a check that is returned for nonpayment. Sometimes called a bounced check or a bad check, most NSF checks are usually returned within days after beingness deposited. In nigh cases, the bank will besides charge your business organization a returned check fee that usually ranges from $10 upward to $35 or even more in some cases.

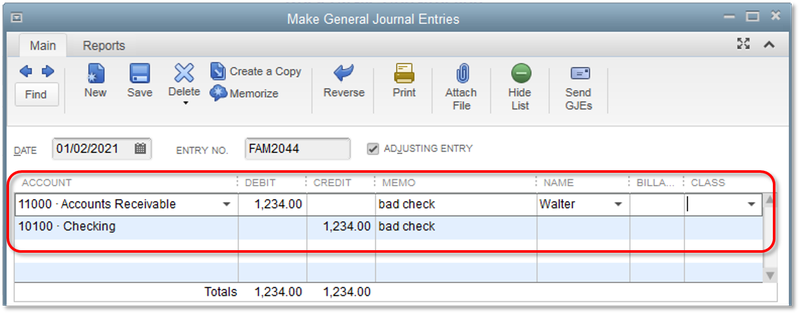

NSF checks directly impact your accounts receivable balance as well as your cash balance, so you'll need to be sure that you record both the NSF cheque and the cheque fee properly. This is an easy process if you're using accounting software just volition require multiple entries if y'all're recording accounting transactions manually.

QuickBooks Desktop makes information technology piece of cake to record an NSF check using a general periodical entry. Source QuickBooks Online software.

How fees work for NSF checks

If you deposit a check that is later returned, your bank volition likely charge you an NSF fee. Nearly banks charge between $25 to $35 for a returned check, though the NSF cheque fee can vary widely, depending on where you depository financial institution. Your business may also have an additional returned check fee that the client volition be charged, along with the rest of the corporeality owed and the fees charged by your banking company.

5 deportment you lot tin can take afterward accepting an NSF check

If your business accepts checks equally a form of payment, there will probable be a twenty-four hours when one of those checks is returned for non-sufficient funds. While your initial response may be anger, there are actionable steps you tin can take to resolve the situation and get paid.

1. Contact the client that wrote the NSF cheque

Anytime you receive an NSF check, you should notify your customer immediately. An NSF bank check isn't always nefarious. The NSF tin can be for bereft funds, but it can also exist a bank error, with your client as upset as you are. Simply whatever the reason, the fact is that their NSF check is costing you lot both payment on the particular purchased as well as an actress fee from the bank.

When you lot practise contact your client, brand payment arrangements immediately, giving them a date when reimbursement is due. Nigh banks endeavour to eolith a check twice earlier returning it to the depositor, so don't concur to attempt and redeposit the cheque a second time. If it doesn't go through, you'll simply be hit with another fee.

2. Send a new beak with the bank fee included

In one case you've been in contact with a customer, or have left a message, ship them a new pecker that includes the returned cheque fee as well as any fees you may have for NSF checks.

Reimbursement of NSF fees is not subject to regular payment terms, so make sure you indicate that the full amount is due upon receipt. You'll likewise want to ask for payment in the grade of a money order or cashier'southward check. You may also want to consider whether you wish to prohibit them from paying past check in the future.

three. Transport a demand letter

If y'all haven't received payment within 10 days, your adjacent pace should be to transport a need letter of the alphabet. Be sure to send the letter certified and so yous take a record of the date it was sent in case you need to take legal activeness against the customer.

4. Plough it over to a collection agency

If yous experience you've explored all your options, you may desire to consider turning the affair over to a drove bureau. Because collection agencies take a portion of the amount nerveless, using a collection agency is a better option for NSF checks that are less than $150 since court costs could finish upwards costing you more than the money you're owed. Nonetheless, for larger amounts, the next step is a better option.

5. Initiate legal action

Your final choice may exist to sue your customer in your state's small claims courtroom. Be certain to find out what the maximum merits limit is for your land before filing a claim. If you exercise proceed to file a claim in your state's small claims courtroom, be sure you have copies of all the necessary documents, such as the original bill, the returned check, and any subsequent correspondence you lot have sent your customer when appearing in court.

Tips for reducing the take chances of accepting NSF checks

The best way to reduce your take chances of accepting an NSF cheque is to terminate accepting checks. If that's not an choice for your business, there are other things you tin do to help mitigate the risk of accepting an NSF bank check.

1. Create a check credence policy

Create a cheque acceptance policy for your business and make sure that all your employees follow it. The policy should include what steps need to be taken when accepting a check as payment as well as potential red flags to look out for.

2. Examine the check carefully

Take a few extra minutes to examine whatsoever check that you receive. Is it missing a preprinted proper noun and address at the top of the bank check? Does information technology accept the name of a legitimate financial institution printed on the check? Is the routing number legitimate? Does the check expect fake? If anything stands out to you, contact the fiscal institution listed on the check and verify the funds, or simply refuse to accept the cheque.

three. Check identification

While this is not an option if you receive checks past mail, if you're accepting a bank check in person, be certain to check the presenter'due south identification. Verify that the addresses friction match and write down their driver's license number. If a customer balks at presenting an ID, simply refuse to accept the check.

4. Use a check verification service

If you commonly take a lot of checks, it may be worth the cost to utilise a cheque verification service. A check verification service lets you know if an account is valid and whether there are sufficient funds in the account. A check verification service can be costly, so be certain to check around for ane that's in your business budget.

There are ways to protect your business from NSF checks

If you admittedly demand to accept checks from your customers, exist sure to put some safeguards in identify to protect your business. If you want to cut down on the number of customers that pay by cheque, consider offer other payment processing alternatives such as ACH and electronic payments, which may brand your customers less inclined to write a check.

Finally, if you are standing to have checks from customers, make certain that you have a check acceptance policy in identify and that your employees follow that policy at all times.

The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an involvement in companies mentioned.

cooperhichislon75.blogspot.com

Source: https://www.fool.com/the-blueprint/nsf-check/

0 Response to "If a Company Has a Check Nsf Do They Try and Cash It Again"

Enviar um comentário